Onyx API Flow

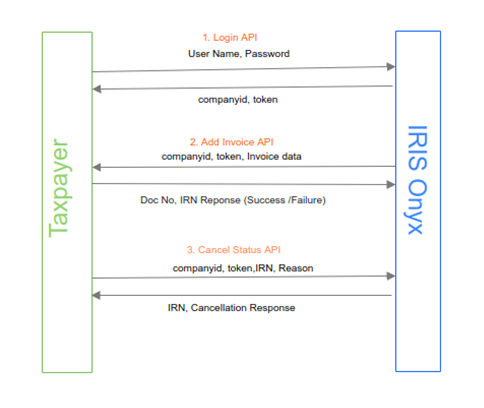

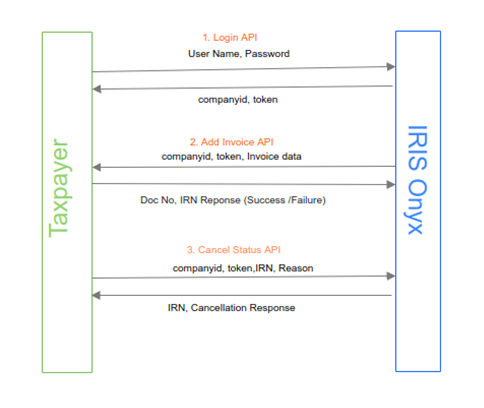

Integration with Data APIs

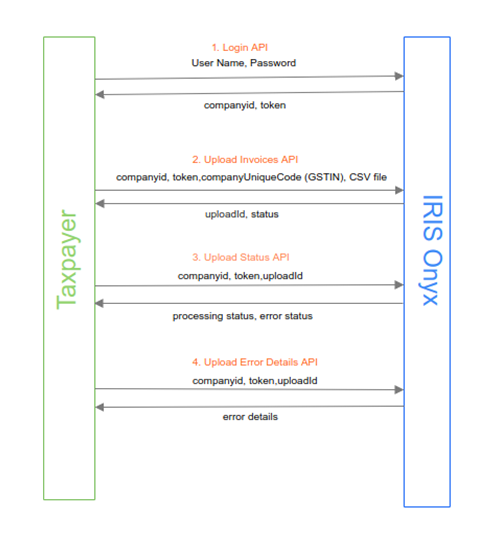

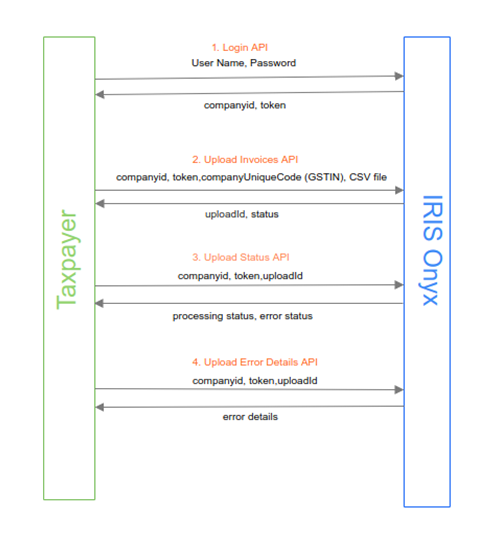

Integration for Upload Files

REST APIs for GST, Eway Bill and E-invoicing for taxpayers to integrate directly or via system integrators.

IRIS is one of the leading compliance solution provider globally and in India. Selected as GSP in the very first round, IRIS GST has been associated with the GSTN ecosystem since its inception and is aligned with India Stack APIs – a set of APIs that allows governments, businesses, startups and developers, to utilize a unique digital Infrastructure to solve India’s persistent problems and move towards presence-less, paperless, and cashless service delivery.

| Category | API Name | API Description | Short URL |

|---|---|---|---|

| Authentication | Login | Login to IRIS Onyx. The token received in response to be used in all subsequent API requests. Token is valid for 24 hours or logout, whichever is earlier | mgmt/login |

| Core Onyx | Generate IRN | Sending single invoice data for IRN generation | irn/addInvoice |

| Core Onyx | Cancel IRN | Cancel a generated IRN. Cancellation is allowed within 24 hours of generation | irn/cancel |

| Upload Invoice | Upload File | Uploading one or multiple invoices for a single GSTIN in a CSV file. The CSV file will be the IRIS specified format | /upload/invoices |

| Upload Invoice | Upload Status | Check the status of uploaded file by providing upload ID | /upload/status |

| Upload Invoice | Upload Errors | Get details of errors during upload file | /upload/errors |

| View Invoice | View List | To get list of invoices based on the criteria selected and summary details for every invoice | /einvoice/view |

| View Invoice | View Summary | Get all the details of a single invoice on providing the IRIS invoice ID | /einvoice/details |

| Entity Management | Get GSTINs | Get the list of GSTINs to which the user has been granted access | user/company/filingbusiness |

Integration with Data APIs

Integration for Upload Files

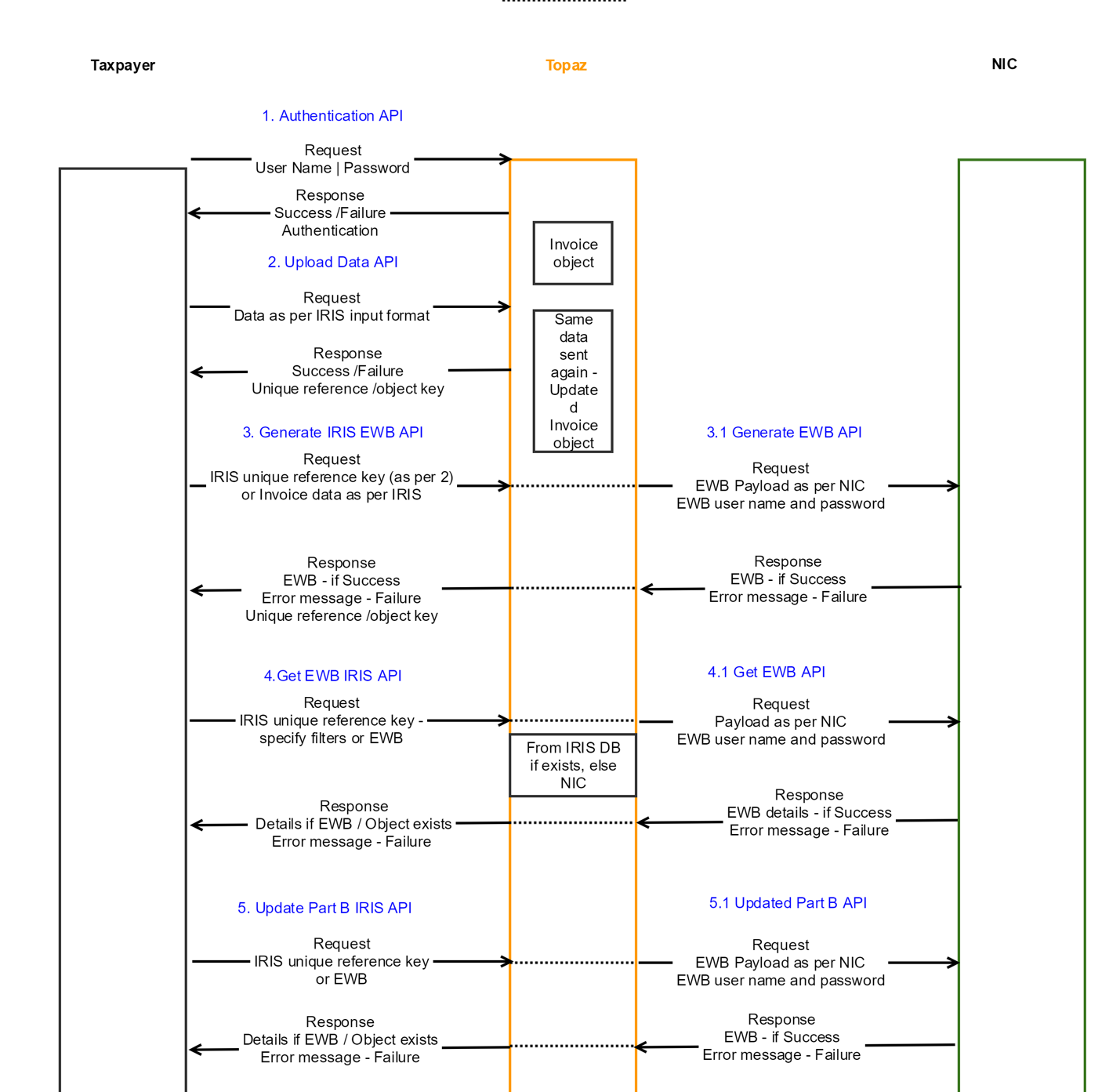

The taxpayers system can connect to the NIC system using the IRIS Topaz APIs. The following image gives an high level view of the interaction between the parties involved i.e. taxpayers systems, IRIS Topaz and NIC systems

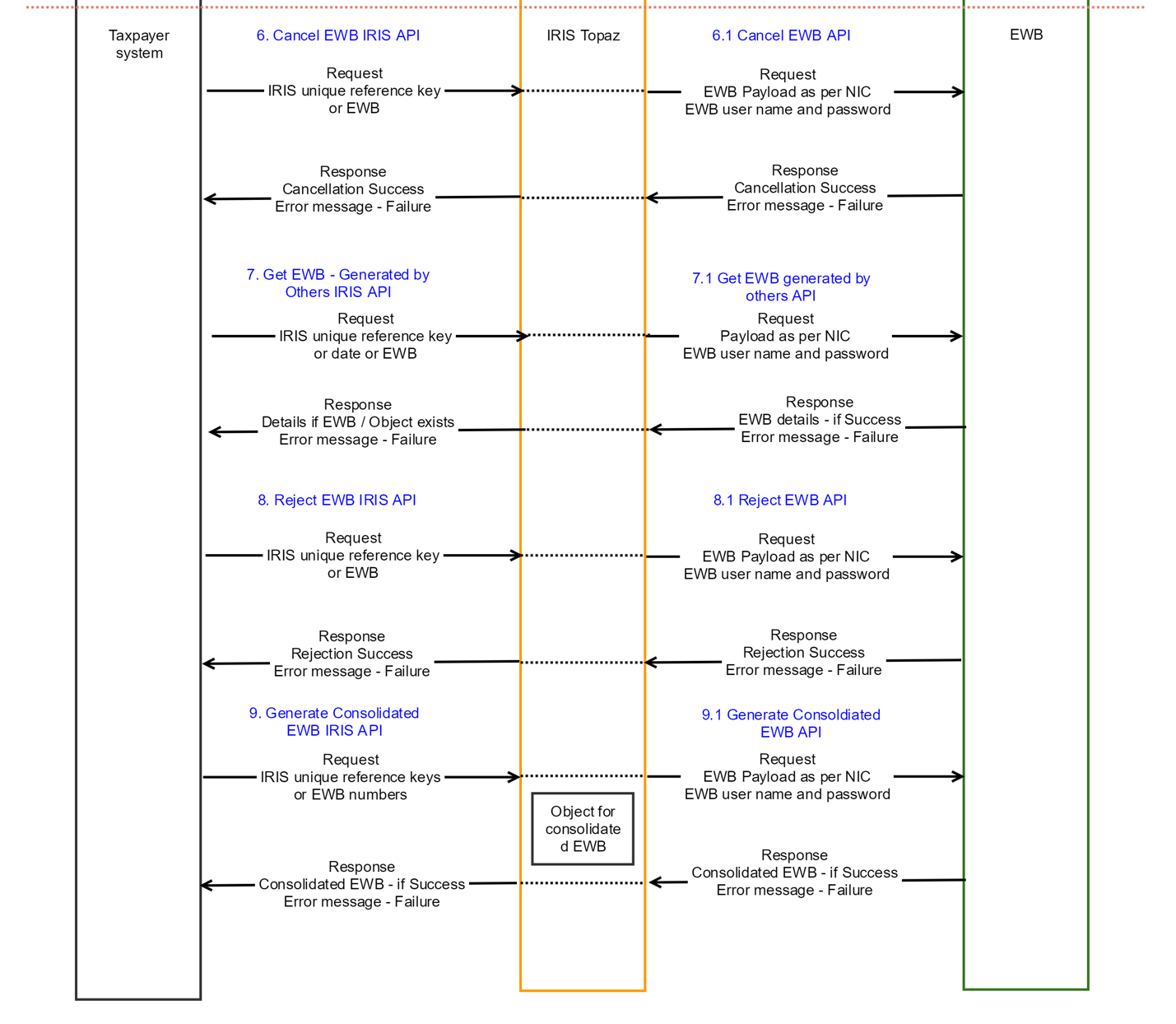

IRIS Peridot is currently making available the common APIs of GST. These APIs do not require any user consent and can be accessed only via GSPs.

Taxpayer Search - https://irisgst.com/kb/search-taxpayer/

Return Status - https://irisgst.com/kb/taxpayer-return-status/

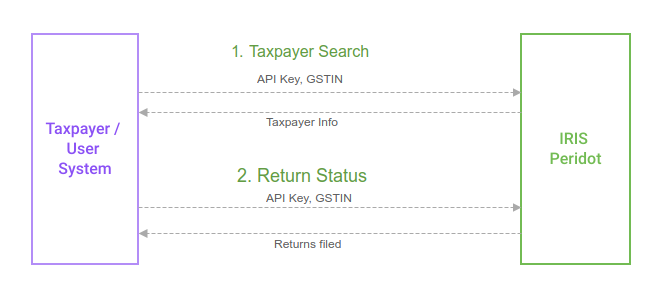

In IRIS Credixo, any request for information is referred to as Order. There will be several types of Orders. The Order Type covered in this document is GST Data.

IRIS Team will set-up the account for the lender and create the first Admin user. The Admin user will need to complete the sign-up process. The Admin user can invite other users to access the account. User sign-up and management will be done through the web interface of IRIS Credixo.

High level Process Flow for IRIS Credixo API.

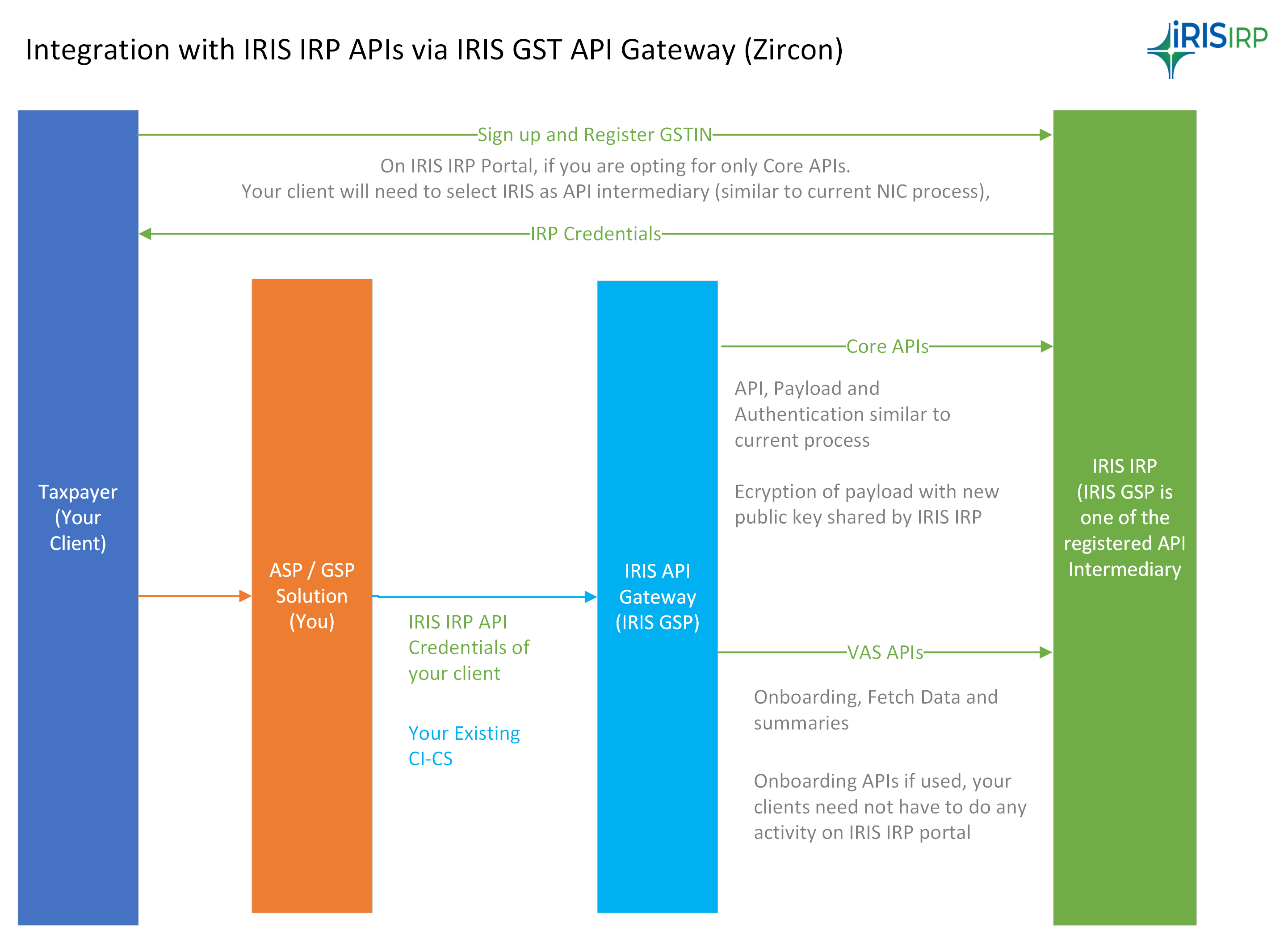

IRIS IRP is platform for invoice registration. IRIS IRP offers basic e-invoicing APIs and value-added APIs that extend beyond e-invoicing.

Solution providers can sign-up directly on IRIS IRP platform and get access to APIs. More info is available here

Option to get IRIS IRP APIs via IRIS GSP gateway (Zircon) is also available. Solution providers who operate from outside India and do not have Indian IP, can connect to IRIS IRP through GSP gateway. These are passthrough APIs and can be managed using your existing Zircon credentials

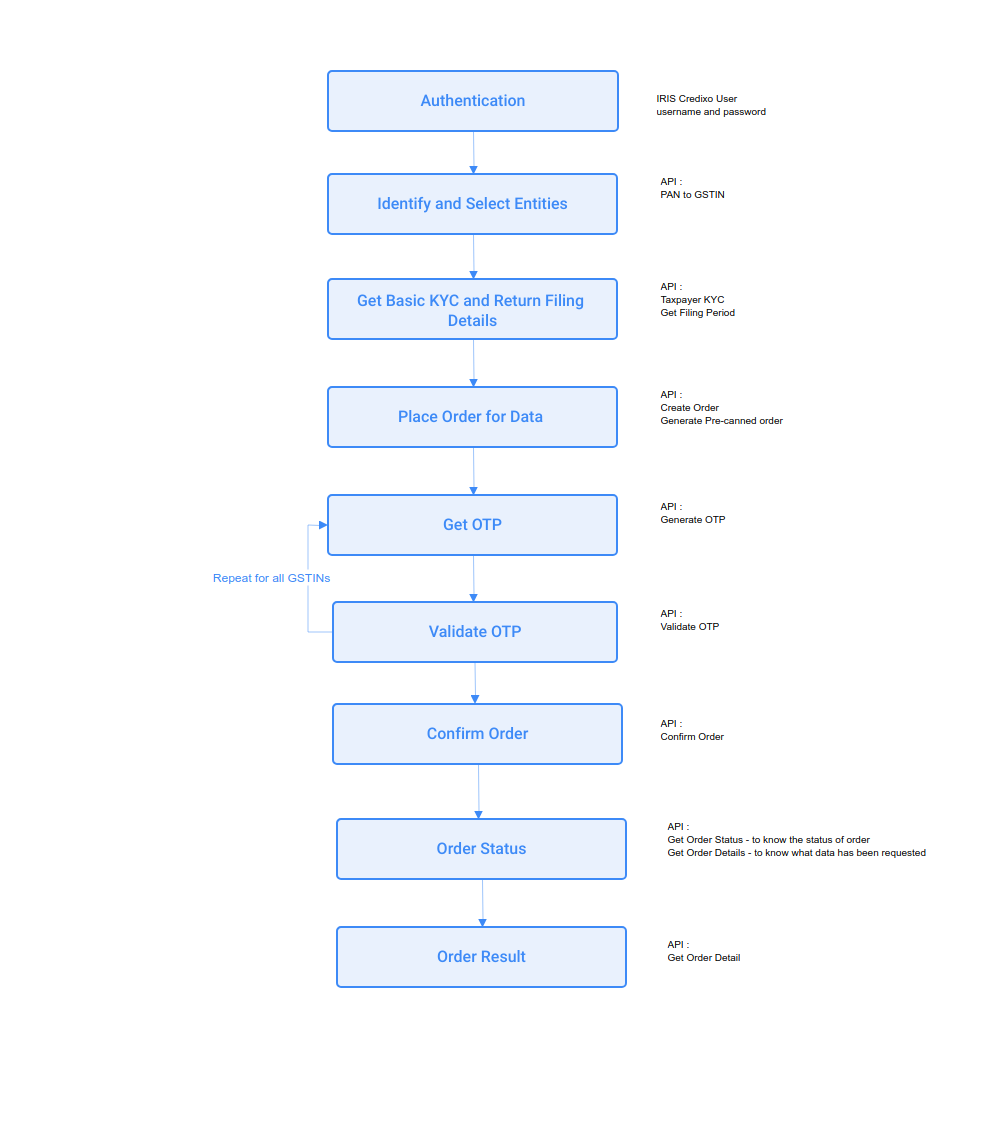

High level Integration process

IRIS ASAP offers a powerful solution for improving Procure-to-Pay processes. It automates tasks, ensures accuracy, and boosts working capital, leading to better financial management and operations. Key features include real-time invoice processing, GST validation, and centralized document management with strict access controls. It also helps optimize resources and synchronize ledgers for maximum efficiency.

IRIS ASAP is ERP agnostic. Organizations can integrate APIs to push data to IRIS platform and also keep information between ERP and IRIS platform in sync.

The Masters maintained in ERP systems need to use while processing the purchase invoices. Hence Master Data sync between ERP and IRIS platform is necessary. Push mechanism is defined for updates wherein ERPs need to push data at periodic frequency to IRIS ASAP

Masters covered in IRIS ASAP are listed here.

| API Name | API Description | Short URL |

|---|---|---|

| Tax payer Master | Get details of Tax payer Master | /master/taxpayer |

| Plant / Project Master | Get details of Plant / Project Master | /master/plant |

| Business Place Master | Get details of Business Place master | /master/business-place |

| Business Area Master | Get details of Business Area master | /master/business-area |

| Cost Center | Get details of Cost Center table | /master/cost-centre |

| Profit Center | Get details of Profit Center | /master/profit-centre |

| General Ledger | Get details of General Ledger | /master/general-ledger |

| Vendor Master | Get details of Vendor Master | /master/vendor |

| Business Partner Master | Get details of Business Partner Master | /master/business-partner |

| Vendor's GST Partner Master | Get details of Vendor's GST Partner Master | /master/vendor-gst-partner |

| PO master Header data | Get details of Purchase order transaction header level | /master/po-header |

| PO master Item level data | Get details of Purchase order transaction item level | /master/po-line-item |

| WO master Header data | Get details of Work order transaction header level | /master/wo-header |

| WO master Item level data | Get details of Work order transaction item level | /master/wo-line-item |

| GRN master Header data | Get details of GRN | /master/grn |

| SRN Master Header data | Get details of SRN | /master/srn-header |

| SRN Master Item level data | Get details of SRN transaction item level | /master/srn-line-item |

| PO Series Master | Get details of PO Series | /master/po-series |

| Tax Code Master | Get details of Tax Code Master | /master/tax-code |

IRIS ASAP has a workflow to validating and processing purhcase invocies. The validated and reviewed can be then pushed to ERP for accounting purposes.

| API Name | API Description |

|---|---|

| Park Invoice in ERP | Post the invoice details from ASAP invoice details to ERP invoice table on Park Status |

| Post Invoice in ERP | Post the invoice details from ASAP invoice details to ERP invoice table on Post Status |

| Ledger Posting / Financial Posting | Post the invoice amounts along with the ledger details from ASAP invoice details to ERP invoice table |

Once invoice gets processed in ERPs, the status updates can be pushed to IRIS ASAP. This will help to get updated view in IRIS ASAP platform and ensure accurate GST compliance

| API Name | API Description |

|---|---|

| Invoice Status Update | Get updated details of invoice from ERP |

| Invoice Posting Update | Get Posting Date, time and amount details from ERP |

| Invoice Payment Updates | Get Payment details (payment flag) of invoice form ERP |

IRIS Sapphire APIs for GST compliance. Invoices and data from taxpayers systems can be sent to IRIS GST using APIs. Taxpayers will need to use the credentials set on IRIS system and business hierarchy needs to be set-up on IRIS. For any upload of data to Government system or fetch of data from there (such as GSTR 2A), the session with GST system via OTP process needs to be established.

Any form of reproduction, dissemination, copying, disclosure, modification, distribution and or publication of this material is strictly prohibited.

© 2020 IRIS Business Services Ltd. All Rights Reserved.